Home Loan Programs

UCSF has currently exceeded the allocation available to fund new Mortgage Origination Program (MOP) loans and cannot accept new nominations for Program support. Nominations for the Mortgage Origination Program support are expected to remain suspended until July 2026 when the next allocation of funding for campus MOP loans will be issued by UCOP. For mission-critical recruitment actions, departments may offer home loan support using their own resources as available. The School of Medicine Dean’s Office is maintaining a wait list for eligible faculty who would like to activate their participation in the Program as soon as it resumes. To be added to that wait list, departments may submit their MOP allocation reservation request packets to Ken Laslavic in the dean’s office following the standard procedure.

• Temporary MOP Suspension—Frequently Asked Questions (FAQ)

• Communication from the Executive Vice Chancellor, August 25, 2025

Concurrently, the campus is working to develop an external home loan program for UCSF faculty independent of funding availability for the MOP, and in the meantime clinical faculty may be able to take advantage of “doctor loans” offered by some lenders. BMO offers a Physicians’ Mortgage Program with benefits similar to the MOP with a discounted rate below their standard mortgage products. Steve Johnson is the BMO program specialist for UCSF faculty: See the BMO Physicians’ Mortgage Program Flyer for more information, or use the direct link for contact information and the program application portal.

The Mortgage Origination Program (MOP) is an additional incentive available to the schools to support specific recruitment needs by offering to assist qualifying new faculty to purchase a first home near campus using a below-market rate mortgage funded by the University. Funding for the MOP is through an allocation from UCOP, and campuses are expected to limit offers of this incentive within the funding allocated. The priority for this recruitment assistance is junior faculty.

Eligibility for nomination to the Program is restricted to new full-time recruits into a Ladder Rank, In Residence, or Clinical X title at the Assistant rank who do not, and have not in the past 12 months, owned a primary residence near campus (defined as San Francisco or one of the four adjacent counties).

- What Faculty Need to Know

-

- Current program loan maximum: $1.5 million.

- Minimum program rate: 3.25% variable.

- The current Standard MOP rate is determined quarterly, and is published on the home page of the Office of Loan Programs.

The Mortgage Origination Program is a pre-approval program and candidates must have a pre-approval certificate before placing offers if they would like to utilize University financing.

- Eligibility for nomination to the Program is restricted to new full-time recruits into a Ladder Rank, In Residence, or Clinical X title at the Assistant rank who do not, and have not in the past 12 months, owned a primary residence near campus (defined as San Francisco or one of the four adjacent counties).

- Deans may offer MOP support for essential recruitments at the Associate rank by exception based on recruitment priorities.

- Adjunct and Health Sciences Clinical Professors are not eligible for this program; however, the chancellor has the authority to offer exceptional MOP participation to essential recruits into a Health Sciences Clinical Professor title if the funding is provided by UCSF Health.

- Schools and departments may apply their own funds to offer Mortgage Origination Program support for the recruitment of Ladder Rank, In Residence, or Clinical X titles at the Associate and Full ranks. Such primary loans will have all the same criteria as a Standard MOP loan but will be funded using the Supplemental Home Loan Program (SHLP) instrument in order to accommodate the campus financing source. While in the form of a SHLP, the loan will be in the first position.

- Eligibility requires that candidates not already own nor have owned in the past 12 months a primary residence in the Bay Area.

- Faculty may participate in the MOP program only once (unless they take a new appointment at a different UC campus).

- The home loan program cannot be used for refinancing.

- MOP loans must be used to purchase primary places of residence which are single family dwellings (house or condominium). They cannot be used for second homes, income-generating property, duplexes, or TICs. No funds may be taken out in borrower equity or used for renovations or construction.

- MOP loan payments are made via payroll deduction.

The Mortgage Origination Program provides first deed of trust variable rate loans with up to a 30-year term; not to exceed a loan-to-value ratio of 90% or a maximum income-debt ratio of 48%. The minimum Standard Rate under the program is 3.25%. There is also a 5/1 MOP by which candidates may lock in a (usually higher) fixed rate for the first five years, after which the loan converts to the Standard Rate (variable).

How much can I borrow? What can I afford?

You can estimate qualifying loan amounts, monthly payments, taxes, and closing costs using the MOP Loan Calculator.How long does this take? What are the steps in the process?

Home Loan Program Steps-Appointment Pending

Home Loan Program Steps-Appointment FinalComprehensive overview and next steps:

For recruits with an appointment pending approval.

For newly recruited faculty who have begun their appointment.

The Office of Loan Programs (UCOP)- Understanding the MOP Rate

-

MOP loans have a variable rate, but it is lower than typical variable rate mortgages found in the market and does not fluctuate like rates do at lending institutions. Bank lending rates are based on a variety of indices and factors, none of which apply to the MOP rate.

The UC Regents fund the Mortgage Origination Program by an allocation from the University of California Short Term Investment Pool (STIP); these funds are invested in faculty mortgages rather than in the pool. As such, the MOP rate is indexed to the income rate of the Short Term Investment Pool. Under this structure, the MOP rate is lower than commercial lending rates and is not subject to the same market conditions.

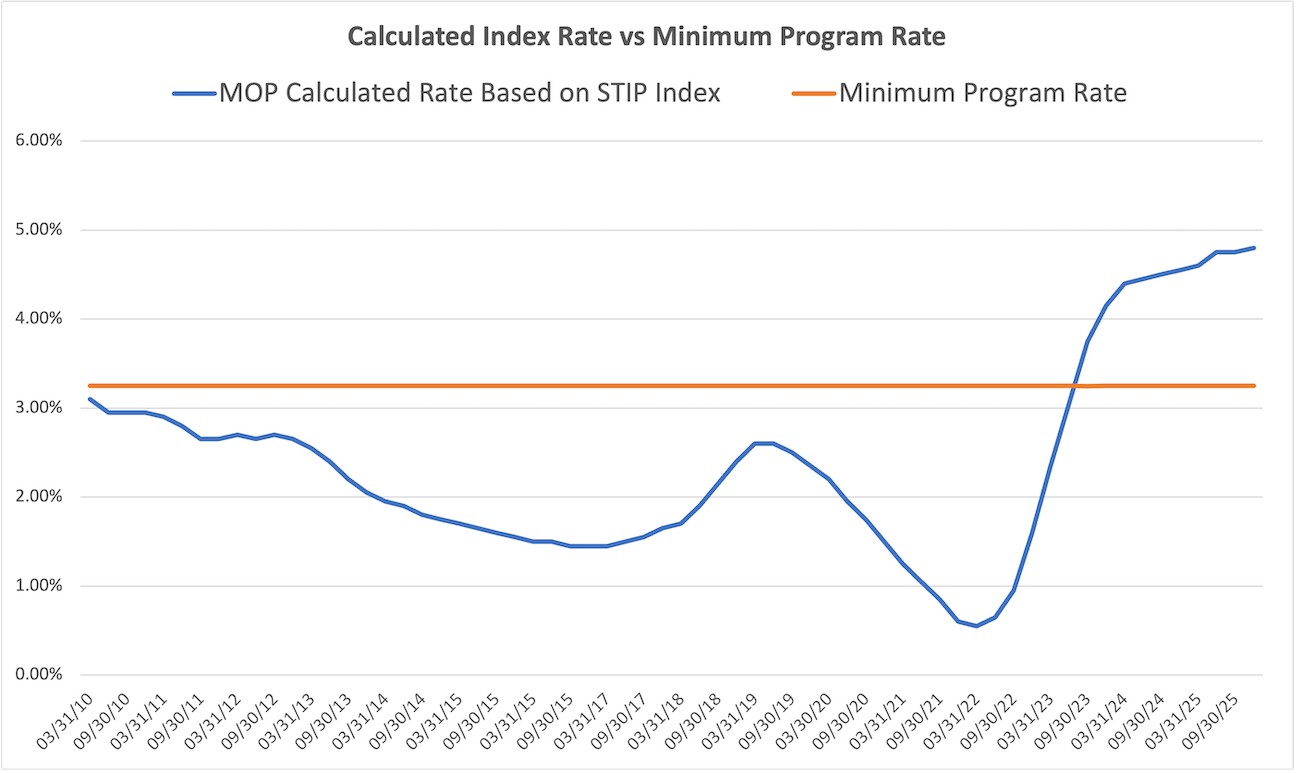

There are two considerations in determining the MOP rate: the Calculated Rate and the Program Rate. The Calculated Rate is the four-quarter average of the STIP rate plus 0.25% servicing fee. To avoid IRS imputed income rules and to keep the program solvent, the program also has minimum rate. The minimum program rate was initially set at 3.0%. was briefly adjusted to 2.75%, and was ultimately set to the current Minimum Program Rate of 3.25%.

Each quarter the Office of Loan Programs issues the effective Program Rate, which is the higher of the Calculated Rate or the Minimum Program Rate.

The calculated MOP rate is determined quarterly and is published by the Office of Loan Programs here.

Active MOP loan rates are only adjusted once annually on the anniversary of the loan, and the MOP rate is prohibited from being adjusted (either up or down) by more than 1.0% at any given adjustment time, and feature a lifetime cap of 10% over the initial rate.

- Administrator Forms & Procedures

-

Schools are expected to limit their nominations for Mortgage Origination Program support and allocation reservations to the funds remaining in the allocation. Nominations are approved for submission by the deans’ offices based on the recruitment priorities of the school.

Department managers may request a MOP allocation reservation and participation in the program for eligible faculty within the first three years of an appointment into a Ladder Rank, In Residence, or Clinical X title by completing the MOP/SHLP Allocation Request Form, affixing the signature of the chair, and submitting it to the Director of Academic Affairs in the appropriate dean’s office with a copy of the fully-executed offer letter. The faculty candidate should not interact with this form.

The following information is to facilitate department managers and academic personnel representatives in requesting faculty participation in the home loan program.

- MOP FAQ

- MOP Summary

- The MOP/SHLP Allocation Request Form

- MOP/SHLP Allocation Request Form for Health Sciences Clinical Professor recruitments. (Requires chancellor’s approval, and funding must be provided by UCSF Health.)

- UCSF-Specific Requirements and Procedures for the MOP

- UCSF-Specific Requirements and Procedures for the SHLP

- The Every Expectation Letter (For requesting participation in the home loan program before a candidate’s academic appointment is fully approved.)

- Steps in the Process

- The MOP Process and HR

- Detailed Program Resources

-

The following are links to more detailed resources governing the University of California Mortgage Origination Program. These pages and documents are provided by the Office of Loan Programs (OLP) at the Office of the President (UCOP). Please note that each campus has its own restrictions and procedures regarding the program.

- The Mortgage Origination Program home page

- Basic MOP Loan Information

- Current MOP Rate

- Overview of the Loan Process

- Frequently Asked Questions (for new borrowers)

- Frequently Asked Questions (for existing borrowers)

- MOP Rate Comparison Chart

- Historic MOP Rates

- Consumer Information

The 5/1 Mortgage Origination Program (5/1 MOP)

- Real Estate Agents

-

To avoid conflicts of interest, the University of California does not recommend nor endorse individual real estate agents. Individual faculty, however, are free to make recommendations regarding their experiences in the home-buying market and may recommend (or not) specific agents who were successful in assisting them with a home purchase using UC Mortgage Origination Program (MOP) financing.

The following real estate agents have been personally recommended by faculty who have closed on a MOP home purchase in the past few years. The University of California and UCSF make no endorsement nor attestation regarding these agents, nor is the University responsible for their conduct should you engage them. This list is provided as an informational resource only as it may assist new or relocating faculty to identify a real estate agent experienced with the Mortgage Origination Program who satisfies their individual needs and preferences. It is important to review potential agents for yourself and decide who best suits your style, location, experience, and other needs. See also: Tips for finding a realtor.

Real Estate AgentsBryce Adams

The Front Steps

[email protected]

415-497-6153C.M. Foo

C.M. Foo

[email protected]

415-706-6550Petra Langer

Compass

[email protected]

415-407-6895Meryl Bennan

Meryl Real Estate

[email protected]

415-637-7059Gabriella Fracchia

Compass

[email protected]

415-794-8639Lauren Neuschel

Krishnan Team

[email protected]

415-371-9869Mike Bohnert

The Bohnert Group

[email protected]

650-504-2378Barbara Stein Friedman

BarbaraSF.com

415-298-8958Andrew Preston

Ascendre

[email protected]

510-410-1851Jodi Campion

Compass (Burlingame)

[email protected]

650-430-4556Julie Gardner

Julie Gardner (Piedmont)

[email protected]

510-326-0840Daniel Risman-Jones

Acendre

[email protected]

415-816-1429Ben and Miriam Chirko

Miriam Chirko

[email protected]

650-740-3593Kaitlin Gilbert

Carey Hagglund Condy (Marin)

[email protected]

415-342-2763Brian Rochford

Rochford Real Estate (East Bay)

[email protected]

925-285-0439Carey Condy

Carey Hagglund Condy (Marin)

[email protected]

415-302-2986Sherry Gray

City Real Estate

[email protected]

415-656-9825Becky Sanchez

Rivet

[email protected]

650-823-7936Serena Conti

Serena Conti

[email protected]

650-619-8398Jeannie Grant

Grant Properties

[email protected]

415-215-7146Houda Tanverakul

Houda Design Realty

[email protected]

415-794-3461Jeremy Davidson

Davidson Group

[email protected]

415-717-4103Judson Gregory

JudsonGregory.com (San Francisco)

[email protected]

415-722-5515Haley Tone

Vanguard

[email protected]

415-302-3455Joshua Deitch

Joshua Deitch (Marin)

[email protected]

415-572-5433Alex Hachiya

Sotheby’s

415-314-6690Lotte Toftdahl

Lotte and Sarah (Marin)

[email protected]

415-412-7471Dan Dodd

Inspire

[email protected]

415-577-9462Tiffany Hickenbottom

Compass

[email protected]

415-933-7001Suki Tsang

Chancere

[email protected]

415-860-9668Ryan Fay

Mosaik Real Estate

[email protected]

415-412-9649Chris Jacobson

Chris Jacobson (Solano County)

[email protected]

707-805-4014Andrew Ulmer

The Gunderman Group (Alameda, Berkeley)

[email protected]

415-225 4343Katie Fones

Compass Nob Hill

[email protected]

415-815-8843Simon Kiang

Simon Kiang (Fremont)

[email protected]

510-938-1898Ned Rote

Ascendre

[email protected]

415-326-5674- Tips for Finding a Real Estate Agent

-

There are well over 4,500 realtors covering San Francisco listed on sfrealtors.com alone, and there are many other resources and reference sources. Realtor.com offers these descriptions of the terms for real estate sales professionals:

- A real estate agent is anyone who has earned a real estate license, whether that license is as a sales professional, an associate broker, or a broker.

- A realtor is a real estate agent who is a member of the National Association of Realtors, which means that he or she must uphold the standards of the association and its code of ethics.

- A real estate broker is a person who has taken education beyond the agent level as required by state laws and has passed a broker’s license exam. Brokers can work alone or they can hire agents to work for them.

- The University cannot make recommendations regarding specific real estate agents or realtors, but we can offer some advice when looking for a real estate agent.

Search online: A Google search will provide several reference sites. Look for someone with experience and familiarity with your interests and areas of interest. Popular local sites for residential real estate information include zillow.com and sf.curbed.com. The San Francisco Bay Area and UCSF are committed to sustainability, and for energy savings and environmental concerns you may want to look for the term “eco-broker” in agent profiles. The San Francisco Association of Realtors is online at www.sfrealtors.com.

Ask around: The best referrals may be from people you know. Put word out to the faculty and staff in your department that you are looking for a real estate agent, and ask if they can recommend someone with whom they have had a positive experience. Other faculty may be best suited to understand your needs as a faculty member and your particular work/life interests and potential neighborhoods.

Look around: Saturdays and Sundays from 1:00 to 4:00 pm, drive or walk to open houses in your neighborhoods of interest. You may find a good home, and possibly a good realtor. Feel free to approach other buyers or sellers and ask about their experience.

Interview potential agents: It is always good to interview at least three realtors before beginning your property search. HowStuffWorks.com has several recommended questions to ask your realtor. Some specific questions to consider:

- What is their number of years in the business and number of transactions per year?

- What are their area(s) of specialization?

- Will you be working directly with them or with an assistant?

- How available are they? Do they work nights? Weekends?

- What is their preferred mode of communication (phone, text, e-mail)? How often will they contact you?

Consider calling a real estate broker or manager at one of the more successful or popular companies in the San Francisco Bay Area and ask for a “buyer’s agent interview.” Ask if they have any agents who are experienced with working with UCSF faculty.

- Other Resources

-

Trying to calculate mortgage payments in general? There are several mortgage calculators online and BankRate.com offers a simple one which may be helpful.

The State of California has recently launched the California Dream For All Shared Appreciation Loan program, a down payment assistance program for first-time homebuyers to be used in conjunction with the Dream For All Conventional first mortgage for down payment and/or closing costs. (This cannot be used in conjunction with the Mortgage Origination Program.)

Heath Sciences Clinical Professors are not eligible to participate in the UC home loan program. However, BMO, Truist, U.S. Bank, and others offer home loan programs specifically for clinicians and doctors. The University makes no endorsements regarding these programs but provides this information as alternative resources which may benefit clinical faculty.

BCU Medical Professional Mortgage Program (contact)

BMO Physician Mortgage Program

GHolden1 Credit Union Doctor Loans Program

LeverageRx Physician Mortgage Comparisons

PNC Medical Professionals Mortgage Program

Truist Doctor Loan Program

U.S. Bank Physician Loan Program

Wintrust Mortgage Medical Loan Program

Home Loan Program Manager: [email protected]